Payroll calculator georgia

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Paycheck Calculator Take Home Pay Calculator

Georgia Salary Paycheck Calculator.

. The results are broken up into three sections. Ad Process Payroll Faster Easier With ADP Payroll. The Peach States beer tax of 101 per gallon of beer is one of the highest.

Georgia has among the highest taxes on alcoholic beverages in the country. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

Georgia Alcohol Tax. Use this Georgia gross pay calculator to gross up wages based on net pay. Well do the math for youall you need to do is enter.

Use this Georgia gross pay calculator to gross up wages based on net pay. For example if an employee earns 1500. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

All Services Backed by Tax Guarantee. Georgia Hourly Paycheck Calculator. In the field Number of Payroll Payments Per Year enter 1.

Luckily our Georgia payroll calculator eliminates all typically the extra clutter related with calculating salaries so your administrative. Get Started With ADP Payroll. For 2022 the minimum wage in Georgia is 725 per hour.

The tax calculator will automatically calculate the. For example if an employee receives 500 in take-home pay this calculator can be. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Use the Georgia paycheck calculators to see the taxes on your paycheck. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Register as an employer on the Georgia Employment.

To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Paycheck Results is your gross pay and specific. Ad Payroll So Easy You Can Set It Up Run It Yourself.

After a few seconds you will be provided with a full breakdown. Georgia Hourly Paycheck Calculator Results. Average monthly salary in Georgia is GEL 1180month USD 397 approx up until the second quarter of 2019 it went all time high of GEL 12025month in the last quarter of the year 2018.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. Free Georgia Payroll Tax Calculator And Ga Tax Rates.

In the income box labelled 1 enter the annual salary of 10000000. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. All Services Backed by Tax Guarantee.

Employers have to pay a matching 145 of Medicare tax but only the. Below are your Georgia salary paycheck results. Just enter the wages tax withholdings and other information required.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross.

How to calculate annual income. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

W12 Tax Form Example Is W12 Tax Form Example Still Relevant Tax Forms W2 Forms Filing Taxes

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

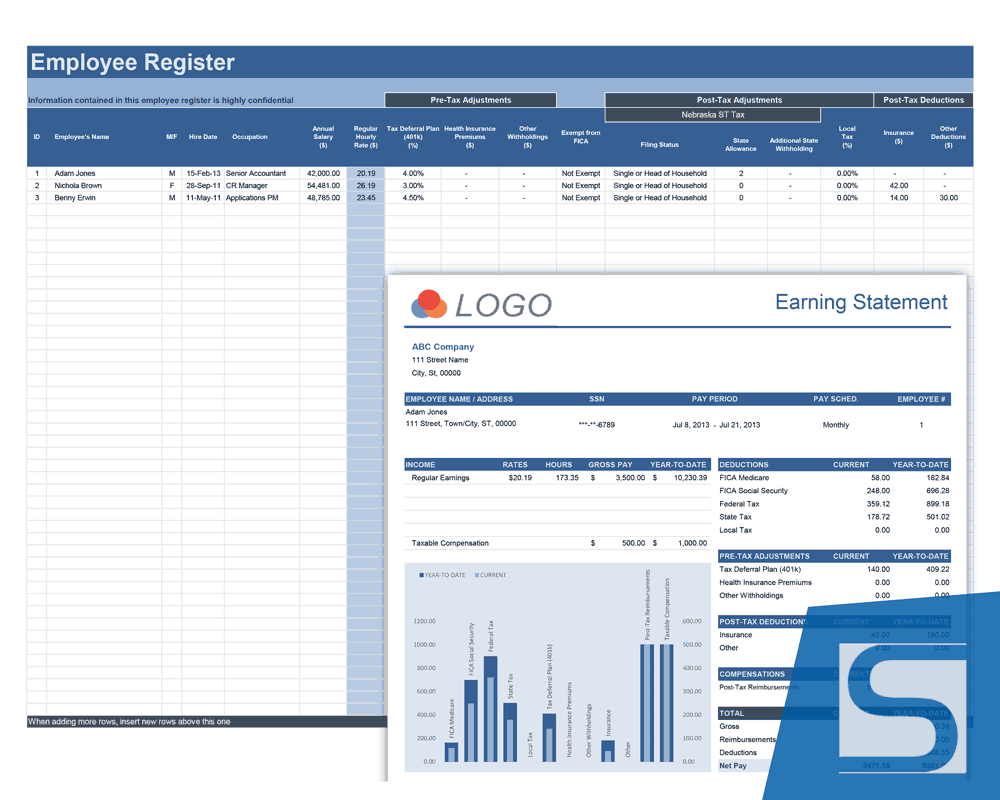

Payroll Calculator Free Employee Payroll Template For Excel

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Download Checkbook Register Excel Template Checkbook Register Excel Templates Checkbook

Paycheck Calculator Take Home Pay Calculator

All Microsoft Excel Templates Free To Download Free For Commercial Use Excel Templates Interest Calculator Credit Card Interest

Payroll Calculator Free Employee Payroll Template For Excel

Georgia Paycheck Calculator Smartasset

Payroll Calculator Free Employee Payroll Template For Excel

Free Corporation Tax Filing With Accounting Package Available At Abacconsulting Taxation Tax Accounting Account Filing Taxes Income Tax Income Tax Return

Prime Cost Calculation Great Article On How How Food And Labor Costs Are Calculated Food Cost Restaurant Management Food Truck